Where's My Tax Receipt?

Wondering if you should be getting a tax receipt for your United Way donation for 2023? Here's what you need to know.

Did you contribute through payroll deduction at your workplace?

If your answer is yes, we don't send tax information for your donation. Payroll deductions happen at your employer, who then sends us a combined check for all participating employees. Because your donation is part of your payroll, you can see your total contribution for the year on your last pay stub of 2023.

Did you make an individual donation or combination of donations of $250 or more?

If your answer is yes, you should be receiving tax information from us for your donation.

If your answer is no, you will not receive tax information from us as the IRS does not require it. Learn more about tax receipt requirements on the IRS website:

If you believe you should have received a tax letter and have not received one by the end of January, please contact us at uwkvfinance@uwkawvalley.org or call 785.273.4804 and follow the prompts for the Topeka office, finance department.

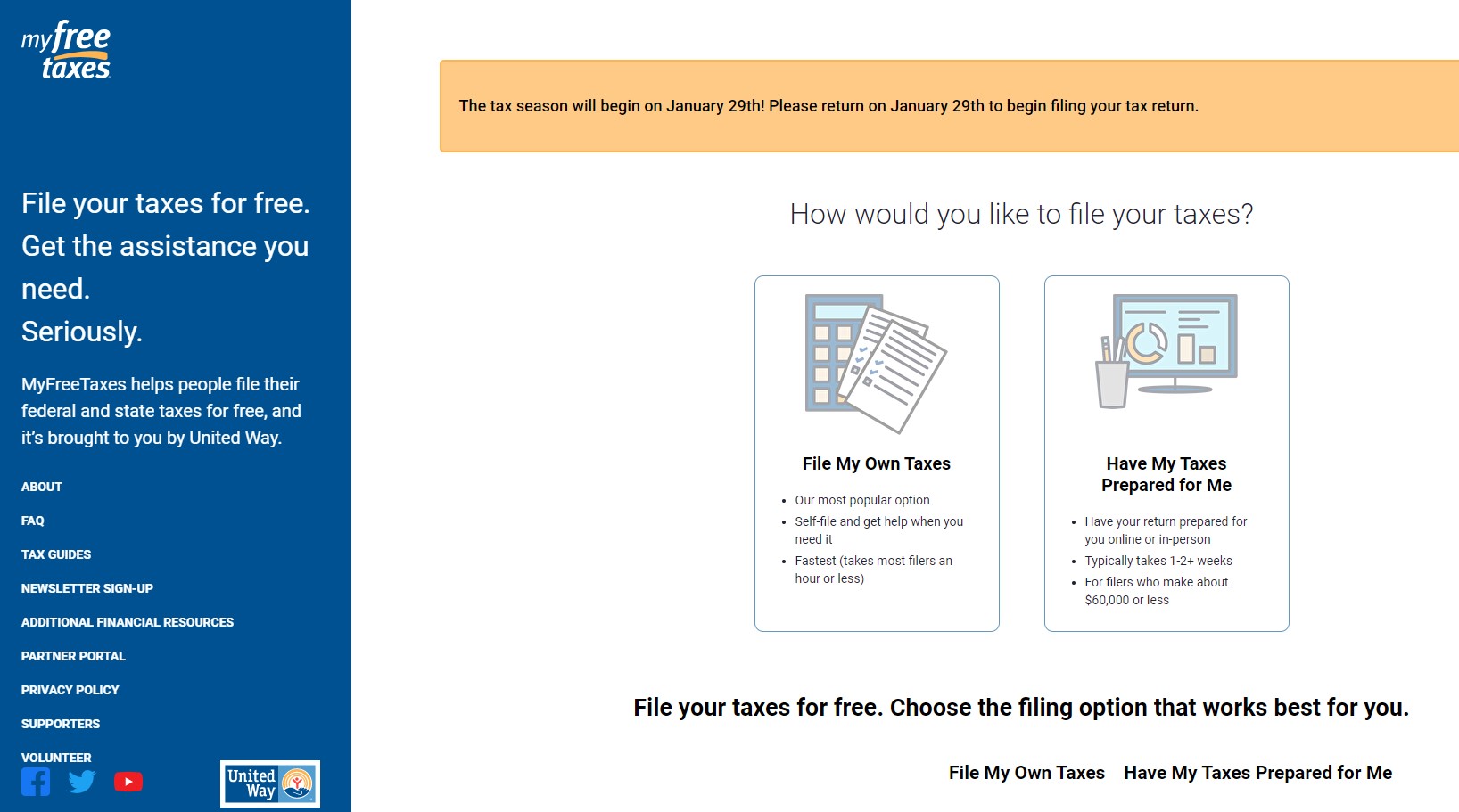

And when it comes time to file your tax return, don't forget that United Way supports MyFreeTaxes.com, which provides free filing access using Tax Slayer online. Depending on your income, could also qualify to have your taxes prepared for free by a certified volunteer with the VITA program. Go to MyFreeTaxes.com to see how you could eliminate your filing fees and take advantage of the MyFreeTaxes.com help line.